Model based Sampling for Poisson Regression

Source:vignettes/Basic_Sampling_Poi_Reg.Rmd

Basic_Sampling_Poi_Reg.Rmd

# Load the R packages

library(NeEDS4BigData)

library(ggplot2)

library(ggpubr)

library(kableExtra)

library(tidyr)

library(psych)

library(gam)

# Theme for plots

Theme_special<-function(){

theme(legend.key.width= unit(1,"cm"),

axis.text.x= element_text(color= "black", size= 12, angle= 30, hjust=0.75),

axis.text.y= element_text(color= "black", size= 12),

strip.text= element_text(colour= "black", size= 12, face= "bold"),

panel.grid.minor.x= element_blank(),

axis.title= element_text(color= "black", face= "bold", size= 12),

legend.text= element_text(color= "black", size= 11),

legend.position= "bottom",

legend.margin= margin(0,0,0,0),

legend.box.margin= margin(-1,-2,-1,-2))

}Understanding the bike sharing data

Fanaee-T and Gama (2013) collected data to understand the bike sharing demands under the rental and return process. The data contains \(4\) columns and has \(17,379\) observations, first column is the response variable and the rest are covariates. We consider the covariates a) temperature (\(x_1\)), b) humidity (\(x_2\)) and c) wind speed (\(x_3\)) to model the response, the number of bikes rented hourly. The covariates are scaled to be mean of zero and variance of one. For the given data subsampling methods are implemented assuming the main effects model can describe the data.

# Selecting 100% of the big data and prepare it

Original_Data<-cbind(Bike_sharing[,1],1,Bike_sharing[,-1])

colnames(Original_Data)<-c("Y",paste0("X",0:ncol(Original_Data[,-c(1,2)])))

# Scaling the covariate data

for (j in 3:5) {

Original_Data[,j]<-scale(Original_Data[,j])

}

head(Original_Data) %>%

kable(format = "html",

caption = "First few observations of the bike sharing data.")| Y | X0 | X1 | X2 | X3 |

|---|---|---|---|---|

| 16 | 1 | -1.334609 | 0.9473452 | -1.553844 |

| 40 | 1 | -1.438475 | 0.8955129 | -1.553844 |

| 32 | 1 | -1.438475 | 0.8955129 | -1.553844 |

| 13 | 1 | -1.334609 | 0.6363514 | -1.553844 |

| 1 | 1 | -1.334609 | 0.6363514 | -1.553844 |

| 1 | 1 | -1.334609 | 0.6363514 | -0.821460 |

# Setting the sample sizes

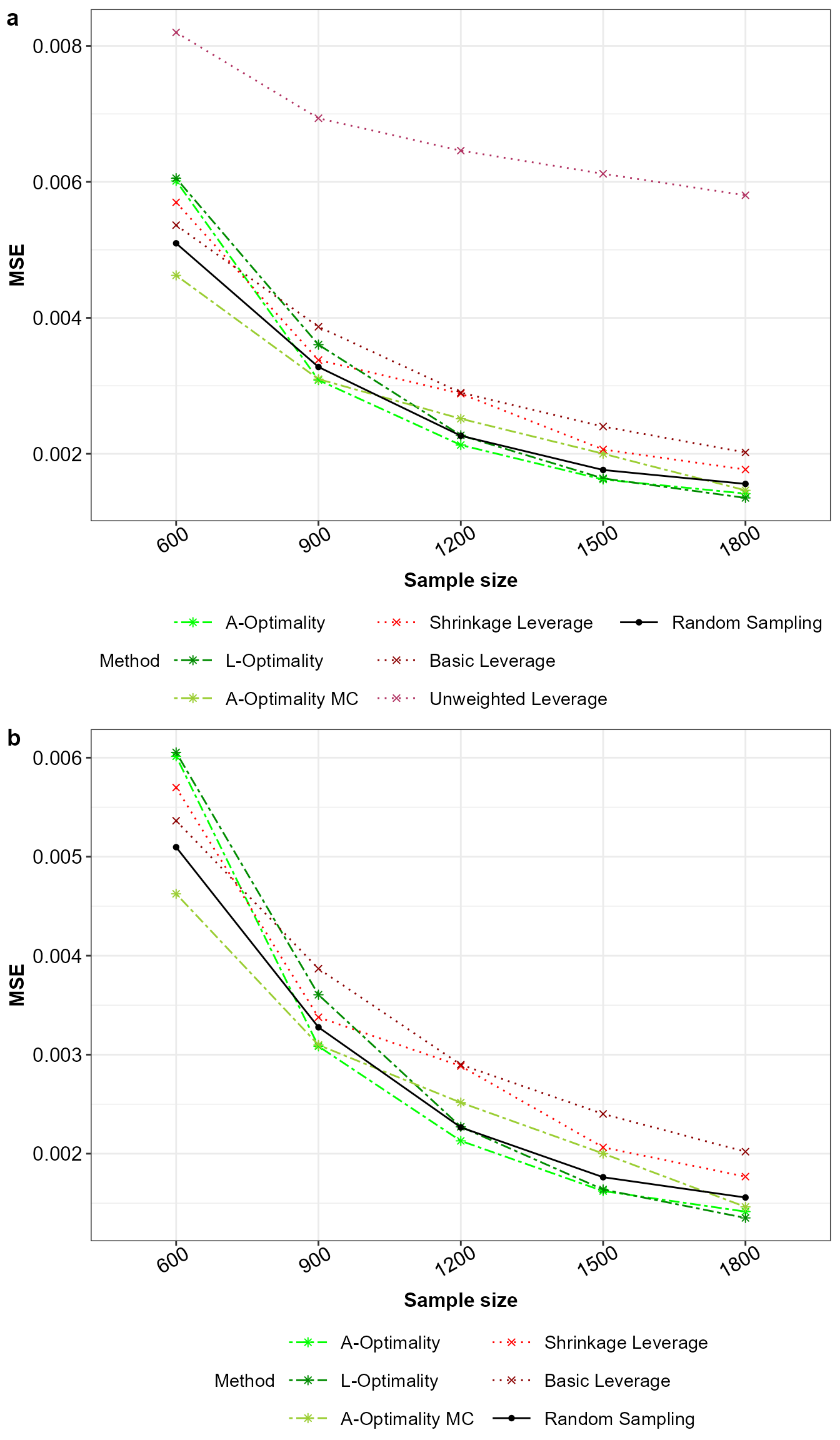

N<-nrow(Original_Data); M<-250; k<-seq(6,18,by=3)*100; rep_k<-rep(k,each=M)Based on this model the methods random sampling, leverage sampling (Ma, Mahoney, and Yu 2014; Ma and Sun 2015), \(A\)- and \(L\)-optimality subsampling (Ai et al. 2021; Yao and Wang 2021) and \(A\)-optimality sampling with response constraint (Zhang, Ning, and Ruppert 2021) are implemented on the big data.

# define colors, shapes, line types for the methods

Method_Names<-c("A-Optimality","L-Optimality","A-Optimality MC",

"Shrinkage Leverage","Basic Leverage","Unweighted Leverage",

"Random Sampling")

Method_Colour<-c("green","green4","yellowgreen",

"red","darkred","maroon","black")

Method_Shape_Types<-c(rep(8,3),rep(4,3),16)

Method_Line_Types<-c(rep("twodash",3),rep("dotted",3),"solid")The obtained samples and their respective model parameter estimates are over \(M=100\) simulations across different sample sizes \(k=(600,\ldots,1500)\). We set the initial sample size of \(r1=300\) for the methods that requires a random sample. From the final samples, model parameters of the assume model are estimated. These estimated model parameters are compared with the estimated model parameters of the full big data through the mean squared error \(MSE(\tilde{\beta}_k,\hat{\beta})=\frac{1}{MJ}\sum_{i=1}^M \sum_{j=1}^J(\tilde{\beta}_{k,j} - \hat{\beta}_j)^2\). Here, \(\tilde{\beta}_k\) is the estimated model parameters from the sample of size \(k\) and \(\hat{\beta}\) is the estimated model parameters from the full big data, while \(j\) is index of the model parameter.

Random sampling

Below is the code for implementing these sampling methods.

# Random sampling

Final_Beta_RS<-matrix(nrow = length(k)*M,ncol = ncol(Original_Data[,-1])+1)

for (i in 1:length(rep_k)) {

Temp_Data<-Original_Data[sample(1:N,rep_k[i]),]

glm(Y~.-1,data=Temp_Data,family="poisson")->Results

Final_Beta_RS[i,]<-c(rep_k[i],coefficients(Results))

if(i==length(rep_k)){print("All simulations completed for random sampling")}

}## [1] "All simulations completed for random sampling"

Final_Beta_RS<-cbind.data.frame("Random Sampling",Final_Beta_RS)

colnames(Final_Beta_RS)<-c("Method","Sample",paste0("Beta",0:3))Leverage sampling

# Leverage sampling

## we set the shrinkage value of alpha=0.9

NeEDS4BigData::LeverageSampling(r=rep_k,Y=as.matrix(Original_Data[,1]),

X=as.matrix(Original_Data[,-1]),N=N,

alpha = 0.9,family = "poisson")->Results## Basic and shrinkage leverage probabilities calculated.## Sampling completed.A- and L-optimality subsampling

# A- and L-optimality subsampling for GLM

NeEDS4BigData::ALoptimalGLMSub(r1=300,r2=rep_k,

Y=as.matrix(Original_Data[,1]),

X=as.matrix(Original_Data[,-1]),

N=N,family = "poisson")->Results## Step 1 of the algorithm completed.## Step 2 of the algorithm completed.A-optimality sampling with measurement constraints

# A-optimality sampling without response

NeEDS4BigData::AoptimalMCGLMSub(r1=300,r2=rep_k,

Y=as.matrix(Original_Data[,1]),

X=as.matrix(Original_Data[,-1]),

N=N,family="poisson")->Results## Step 1 of the algorithm completed.## Step 2 of the algorithm completed.Summary

# Summarising Results of Scenario one

Final_Beta<-rbind(Final_Beta_RS,Final_Beta_LS,

Final_Beta_ALoptGLM,Final_Beta_AoptMCGLM)

# Obtaining the model parameter estimates for the full big data model

glm(Y~.-1,data = Original_Data,family="poisson")->All_Results

coefficients(All_Results)->All_Beta

matrix(rep(All_Beta,by=nrow(Final_Beta)),nrow = nrow(Final_Beta),

ncol = ncol(Final_Beta[,-c(1,2)]),byrow = TRUE)->All_Beta

remove(Final_Beta_RS,Final_Beta_LS,Final_Beta_ALoptGLM,

Final_Beta_AoptMCGLM,Temp_Data,Results,All_Results)The mean squared error is plotted below.

# Obtain the mean squared error for the model parameter estimates

MSE_Beta<-data.frame("Method"=Final_Beta$Method,

"Sample"=Final_Beta$Sample,

"MSE"=rowSums((All_Beta - Final_Beta[,-c(1,2)])^2))

MSE_Beta$Method<-factor(MSE_Beta$Method,levels = Method_Names,labels = Method_Names)

# Plot for the mean squared error with all methods

ggplot(MSE_Beta |> dplyr::group_by(Method,Sample) |>

dplyr::summarise(MSE=mean(MSE), .groups = 'drop'),

aes(x=factor(Sample),y=MSE,color=Method,group=Method,

linetype=Method,shape=Method))+

geom_point()+geom_line()+xlab("Sample size")+ylab("MSE")+

scale_color_manual(values = Method_Colour)+

scale_linetype_manual(values=Method_Line_Types)+

scale_shape_manual(values = Method_Shape_Types)+

theme_bw()+guides(colour = guide_legend(nrow = 3))+Theme_special()->p1

# Plot for the mean squared error with all methods except unweighted leverage

ggplot(MSE_Beta[MSE_Beta$Method != "Unweighted Leverage",] |>

dplyr::group_by(Method,Sample) |>

dplyr::summarise(MSE=mean(MSE), .groups = 'drop'),

aes(x=factor(Sample),y=MSE,color=Method,group=Method,

linetype=Method,shape=Method))+

geom_point()+geom_line()+xlab("Sample size")+ylab("MSE")+

scale_color_manual(values = Method_Colour[-6])+

scale_linetype_manual(values=Method_Line_Types[-6])+

scale_shape_manual(values = Method_Shape_Types[-6])+

theme_bw()+guides(colour = guide_legend(nrow = 3))+Theme_special()->p2

#save(Final_Beta,All_Beta,MSE_Beta,p1,p2,file="Poisson_Regression_Scenario_1.RData")

#load("Poisson_Regression_Scenario_1.RData")

ggarrange(p1,p2,nrow = 2,ncol = 1,labels = "auto")

Mean squared error for a) all the sampling methods and b) without unweighted leverage sampling.